-

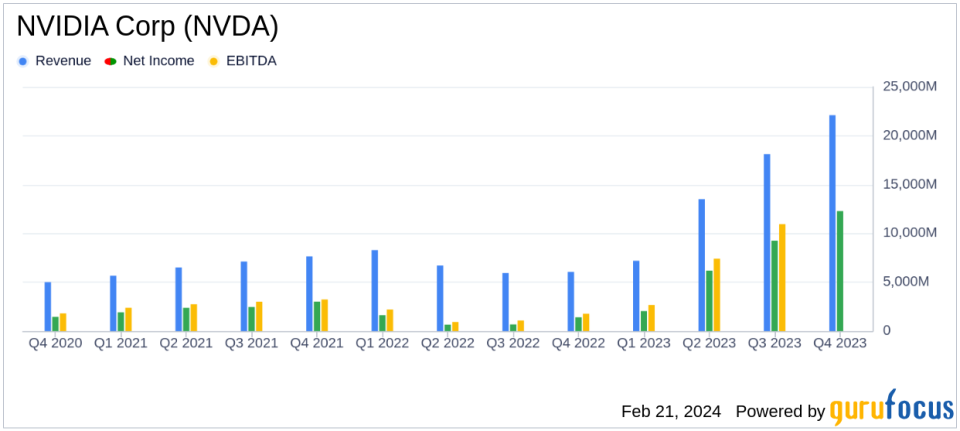

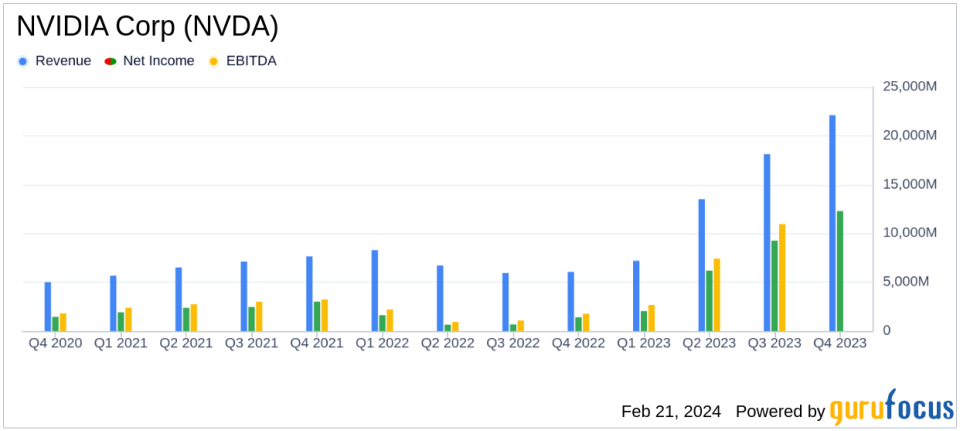

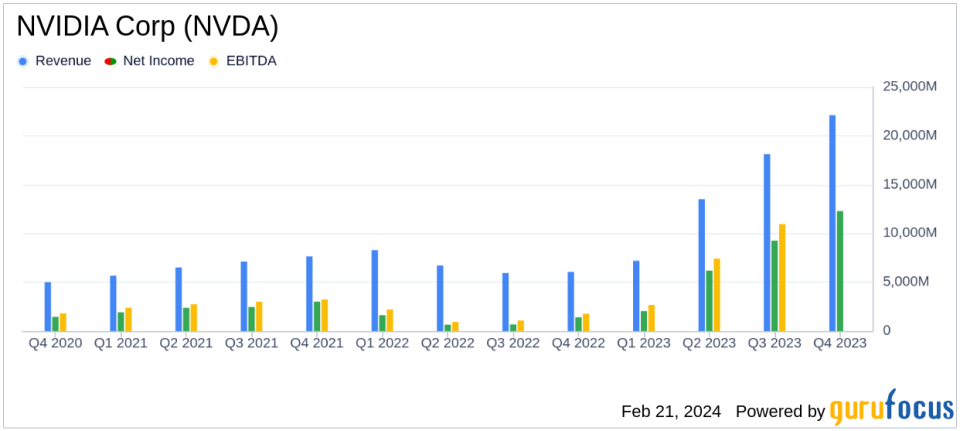

Quarterly Revenue: Reached a record $22.1 billion, a 22% increase from Q3 and a 265% surge from the previous year.

-

Data Center Revenue: Achieved a record $18.4 billion for the quarter, marking a 27% rise from Q3 and a staggering 409% year-over-year growth.

-

Annual Financials: Full-year revenue soared by 126% to $60.9 billion, with GAAP EPS up 586% and non-GAAP EPS up 288% from the previous year.

-

Gross Margin: Improved to 76.0% in Q4 from 74.0% in Q3, and up significantly from 63.3% the previous year.

-

Net Income: Q4 net income jumped to $12.3 billion, a 33% increase from Q3 and a 769% increase year-over-year.

-

Earnings Per Share: GAAP diluted EPS for Q4 was $4.93, up 33% from Q3 and up 765% from the previous year.

-

Dividend: Announced a quarterly cash dividend of $0.04 per share, payable on March 27, 2024.

On February 21, 2024, NVIDIA Corp (NASDAQ:NVDA) released its 8-K filing, revealing a record-breaking performance for both the fourth quarter and the fiscal year 2024. The company, a leading developer of graphics processing units (GPUs) and artificial intelligence (AI) platforms, has seen its products and services become increasingly vital in a variety of sectors, including gaming, professional visualization, and automotive.

Financial Highlights and Company Growth

NVIDIA’s remarkable quarterly revenue of $22.1 billion represents a 22% increase from the third quarter and a 265% increase from the same period last year. This growth was propelled by a record quarterly Data Center revenue of $18.4 billion, which is up 27% from Q3 and up 409% from the previous year. The company’s full-year revenue also saw a significant uptick, reaching $60.9 billion, a 126% increase from the previous fiscal year.

The company’s gross margin improved notably, reaching 76.0% in the fourth quarter, up from 74.0% in the third quarter and 63.3% from the previous year. This expansion in gross margin underscores NVIDIA’s ability to not only increase sales but also to do so profitably, a key indicator of financial health for value investors.

Income Statement and Earnings Per Share

Operating income for Q4 stood at $13.6 billion, a 31% increase from Q3 and a significant 983% increase year-over-year. Net income saw a similar trajectory, with Q4 net income reaching $12.3 billion, up 33% from the previous quarter and up 769% from the same quarter last year. The GAAP diluted earnings per share (EPS) for the quarter was $4.93, which is a 33% increase from the previous quarter and a 765% increase from the previous year. The non-GAAP diluted EPS was even higher at $5.16, marking a 28% increase from Q3 and a 486% increase year-over-year.

These earnings figures are particularly important for NVIDIA, a company at the forefront of the semiconductor industry, as they reflect the successful adoption of its AI and GPU technologies across various sectors. The substantial increase in EPS indicates robust profitability and may signal strong future potential for the company.

Challenges and Future Outlook

Despite the impressive financial achievements, NVIDIA faces challenges inherent in the fast-paced and competitive semiconductor industry. Rapid technological advancements and intense competition require continuous innovation and investment in research and development. Additionally, the company’s forward-looking statements suggest a focus on new product cycles and innovations, which are crucial for maintaining its market-leading position.

NVIDIA’s outlook for the first quarter of fiscal 2025 anticipates revenue to be around $24.0 billion, with GAAP and non-GAAP gross margins expected to be approximately 76.3% and 77.0%, respectively. Operating expenses are projected to be around $3.5 billion on a GAAP basis and $2.5 billion on a non-GAAP basis.

Conclusion and Investor Perspective

NVIDIA’s record-breaking earnings report for Q4 and fiscal 2024 highlights the company’s strong position in the semiconductor industry, driven by its innovative AI and GPU technologies. With significant year-over-year growth in revenue, net income, and EPS, NVIDIA demonstrates its ability to capitalize on the growing demand for accelerated computing and AI. As the company continues to innovate and expand its product offerings, investors will be watching closely to see how it navigates the challenges ahead and capitalizes on the opportunities presented by the evolving tech landscape.

For a detailed analysis of NVIDIA’s financial performance and future prospects, investors are encouraged to review the full earnings report and accompanying commentary by NVIDIA’s executive vice president and chief financial officer, Colette Kress, available on the company’s investor relations website.

Explore the complete 8-K earnings release (here) from NVIDIA Corp for further details.

This article first appeared on GuruFocus.