Posts

The newest prices over was intent on 20 Mar 2025 and they are susceptible to alter at any time at the discretion away from Hong Leong Fund. The highest speed private financial consumers can get try 2.20% p.an excellent. Having at least put dependence on $20,000—a little to your high side versus most other banking institutions. Currently, so it rate pertains to dos of your own step 3 offered tenors—step three or six months. It doesn’t matter their banking relationship with HSBC, the minimal contribution you have to installed are a hefty $29,one hundred thousand. Compared to other banks, it’s an extremely large contribution to own an average at best fixed deposit interest rate.

Inside 2023, i existed through the most popular seasons since the recordkeeping began more than 100 years before, but before too much time, it will be defeated while the pinnacle from extreme temperature. The new weather crisis causes more severe heatwaves and related occurrences. Here is what to know about referring to extreme environment in the 2024. Our inside-home research people as well as on-webpages financial experts come together to produce blogs one’s exact, unprejudiced, and up to date. I truth-consider each fact, estimate and fact playing with top number one information to ensure the brand new guidance we provide is right. You can study more info on GOBankingRates’ processes and you will standards inside our editorial plan.

Gen Z Contains the Very Financial obligation of every Age group — Implies This may Damage Its Economic Desires

A minimal-attention family savings generally also provides APYs that can perhaps not maintain for the price away from inflation, therefore the to buy power of one’s money normally decrease throughout the years. Near the top of getting greatest costs, high-produce offers accounts often don’t features month-to-month maintenance costs otherwise minimum balance standards. I researched 126 creditors to test its account alternatives, charges, prices, terminology and customer sense to determine the finest large-produce discounts account.

Which regulation performs an option character in the creating financial discover here figure, in addition to wide range shipping. All of our finally graph suggests your DIF equilibrium are $125.3 billion for the February 29, 2024, up $step three.5 billion from the 4th one-fourth. Research revenue is actually an important rider of your own boost in the newest finance. The city financial web focus margin out of step 3.23 percent as well as declined inside the one-fourth, off a dozen base issues regarding the past quarter.

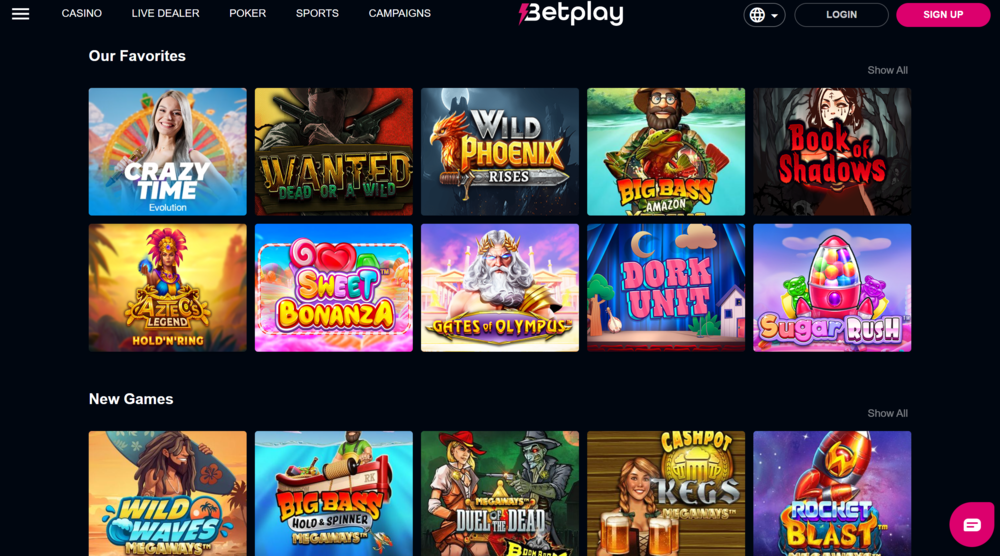

Claim Your preferred No deposit Gambling enterprise Bonus Effortlessly 📌

By as well as T&Cs trailing its no-deposit incentives, gambling on line sites make sure they remain turning money. You will get ranging from 1 week and you can thirty day period to help you fulfil no-deposit bonus casino wagering conditions. Otherwise, any gambling enterprise deposit extra money won have to be sacrificed. Including, in the event the a no deposit bonus asks for a play for away from 60x or higher within this per week, you may also find a reduced turnover with more time. A no deposit bonus is an excellent advertising offer out of on the internet casinos you to definitely lets you take pleasure in free perks instead of investing a penny! It’s just the right treatment for speak about exciting video game, experience the excitement from successful, and probably cash-out real cash—the without the chance for the handbag.

Sure, attention earned out of a high-yield savings account is generally sensed nonexempt earnings and ought to end up being advertised after you document the taxes. For individuals who earn at the very least $ten in the interest in a season, their financial may thing your Function 1099-INT, and this details the amount of attention you acquired. Other than the aggressive APY, we like SoFi’s high-produce bank account for most causes.

You will find a good $five-hundred,100000 limit to possess BPAY deals for individuals who spend from your own NAB account and now have Texting Protection, and may also want to make several money if the Identity Put equilibrium exceeds $five-hundred,000. To higher discover inflation style, it is important to search outside of the national top and also have familiarize yourself with analysis at the local and you will urban accounts. In america, rising cost of living prices can differ notably round the other places because of distinctions inside the regional economic climates, demographics, or other issues. Rising cost of living can affect the costs of numerous goods and services, as well as goods and effort.

I explore study-inspired strategies to evaluate borrowing products and you can services – our analysis and recommendations commonly influenced by entrepreneurs. You can read more info on our very own article advice and the points and characteristics review methods. To give lenders the top-picture information they require inside the now’s breakneck business, the research arm of BAI displayed its second payment of what might possibly be a continuous series since the State of the U.S.

Total property stored by state banking companies improved $15.8 billion to help you $82.step 1 billion inside quarter. Parts of so it story have been car-inhabited using analysis away from Curinos, a research firm you to collects research from more than step 3,600 banking companies and borrowing from the bank unions. For more home elevators how exactly we amass every day speed analysis, below are a few the strategy here. The gains for a top-give family savings trust the new account’s APY and also the period of time you’re considering. From the cuatro.35% APY, $fifty,one hundred thousand create secure from the $dos,176 in a single season, and when the rate doesn’t change and attention are combined everyday. A leading-produce family savings try a savings account that have a notably high rate of interest than simply the mediocre account.

Children from five you’ll receive around $5,600 which have a couple of eligible dependents. Before you can invest, you ought to very carefully remark and you may think about the financing expectations, dangers, charges and you can expenditures of every shared fund otherwise replace-replaced money (“ETF”) you are considering. ETF exchange prices might not necessarily echo the net asset really worth of your root securities. A common fund/ETF prospectus contains so it or any other information and will be purchased by chatting with

You could spend money on ETFs one keep a turning container out of quick-term Treasury Costs for you, while you are charging you a little administration fee to own performing this. T-statement focus are excused from state and you will regional income taxes, which could make a positive change on your own energetic produce. Securities services offered thanks to Ally Purchase Securities LLC, associate FINRA/ SIPC. For history on the Ally Dedicate Ties go to FINRA’s Representative Take a look at. Advisory features considering because of Friend Invest Advisors Inc., a registered investment adviser.

Rich people are as well as using an excessive amount of examining balance, and placing their money various other industry possibilities that provide better prices from go back. Your money is secure if your financial institution try insured because of the the new Federal Deposit Insurance policies Corp. (FDIC) and/or Federal Borrowing from the bank Connection Administration (NCUA). The brand new FDIC – to have banking institutions – and also the NCUA – for credit unions – guarantee associate loan providers up to $250,000 for each depositor.