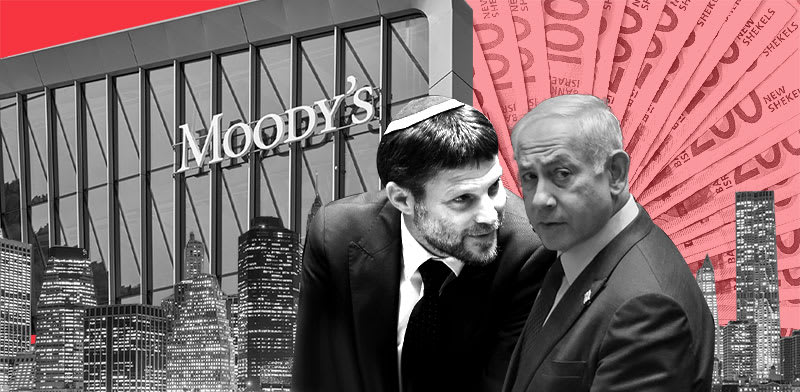

Moody’s has cut Israel’s credit rating from A1 to A2, due to the effects of the war. The international ratings agency has also lowered Israel’s outlook from stable to negative and sees a possible further downgrade in the future. In effect, Moody’s has taken the most drastic rating action possible, surprising even the most pessimistic market forecasts. This is the first time that Moody’s has ever cut Israel’s credit rating.

Moody’s analysts say, “The main driver for the downgrade of Israel’s rating to A2 is Moody’s assessment that the ongoing military conflict with Hamas, its aftermath and wider consequences materially raise political risk for Israel as well as weaken its executive and legislative institutions and its fiscal strength, for the foreseeable future.”

Political, security and social risks

The attached explanation of its decision focuses on an analysis of military, political and social factors in Israel. “The State of Israel could confront a period of intensified internal political upheaval when the war cabinet breaks up.” Moody’s also sees the rise in security risks as connected to the rise in social risks in the State of Israel, and thinks, “Israel’s exposure to political risks might, with high probability, continue into the foreseeable future, even if the fighting in Gaza diminishes in intensity or pauses.”

On the economic side, there is a gap between the severity of the rating decision and Moody’s description of Israel’s economy in this latest review. Moody’s writes, “So far the economy has managed the fall-out from the conflict reasonably well, with high-frequency indicators pointing to a swift rebound over the past three months.”

Moody’s also mentions positively the planned budgetary measures being taken by the Ministry of Finance including raising VAT from 17% to 18% from 2025. Moddy’s writes, “The government’s willingness to raise taxes is a positive sign about the strength of the country’s institutions, given the reluctance of successive governments in the past to consider higher taxes,” and, “If approved in full, these measures could broadly compensate the higher defense and interest spending, although budget deficits will remain much wider than expected before the conflict.

The power of civil society is substantial

Before the war, Moody’s was the most critical of the three international ratings agencies on the government’s judicial overhaul and lowered Israel’s credit outlook from positive to stable. Now, despite the downgrade, says positively, “Moody’s assessment also takes into account the strong track record and recent indications of the strength of civil society and the judiciary, which have shown to provide strong checks and balances. The Supreme Court cancelled the government’s attempt to restrict judicial overview, underlining the strength and independence of the judiciary. Moreover, the strength of civil society has been on display since the start of the military conflict.”

In recent weeks, the Ministry of Finance and Ministry of Defense have agreed on a ‘strengthening’ budgetary addition of NIS 100 billion over seven years. Moody’s writes, “In its baseline scenario, Moody’s expects Israel’s defense spending to be nearly double the level of 2022 by the end of this year and to continue to rise by at least 0.5% of GDP in each of the coming years, with risks tilted towards yet higher defense spending.”

On the negative side, Moody’s writes, “As a result of much higher budget deficits, Israel’s government debt ratio will rise to a peak of 67% of GDP by 2025, from 60% in 2022. Before the conflict started, Moody’s expected that Israel’s debt burden would decline towards 55% of GDP.” However, it should be said that even the forecast of 67% reflects a relatively low debt-GDP ratio for a developed economy, and is below the 70% recorded during the Covid crisis.

Moody’s also says, “The negative outlook reflects Moody’s view that downside risks remain at the A2 rating level. In particular, the risk of an escalation involving Hezbollah in the North of Israel remains, which would have a potentially much more negative impact on the economy than currently assumed under Moody’s baseline scenario.”

Moody’s adds, “Conflict with Hezbollah would pose a much bigger risk to Israel’s territory, including material damage to infrastructure, renewed calls on reservists and further delays to the return of the evacuees to the region. The Ministry of Finance estimates that real GDP could contract by up to 1.5% overall this year if this downside scenario materialized compared with positive growth of 1.6% under a status quo scenario.”

Published by Globes, Israel business news – en.globes.co.il – on February 10, 2024.

© Copyright of Globes Publisher Itonut (1983) Ltd., 2024.